Americans are responsible for saving for retirement, and employer-sponsored defined contribution plans are intended to make it easier. Rules and limits are supposed to level the playing field, but they may also keep some people from maximizing their savings.

402(g) limits restrict the amount a participant can contribute to a 401(k) plan. Essentially, they only limit the higher-earning participant, as most people can’t afford to contribute up to the threshold. High-income participants need to find ways to save more for retirement, and although 402(g) contribution limits make it harder, proactive plan design can open the door to retirement readiness.

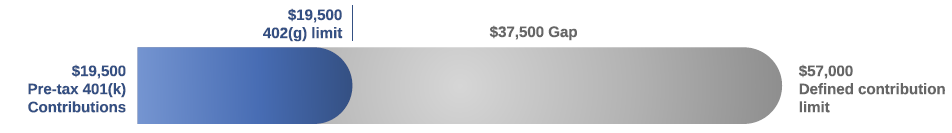

CONTRIBUTION LIMITS

The 402(g) limit on 401(k) contributions for 2020 is $19,500; the limit on annual additions to a defined contribution (DC) plan for 2020 is

$57,000. The $37,500 gap between the two limits is where employer match falls, but it rarely makes up the entire difference.

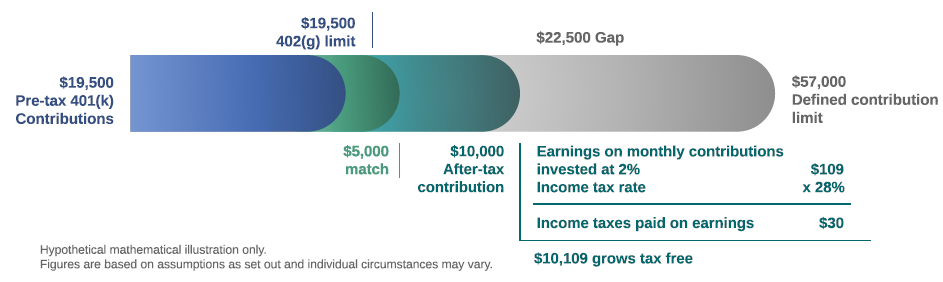

Participants who want to maximize their retirement savings by filling in the gap can make after-tax contributions until they hit the $57,000 limit. Even in the few plans that allow this type of savings, however, few participants do so because the earnings on the after-tax savings are taxed as regular

income. If they save that money outside the plan, it is taxed at the lower capital gains rate.

What if there was a tax-friendly way to save up to $57,000 in a 401(k) plan?

THE OPPORTUNITY

Participants may make after-tax contributions to a qualified plan and then convert those contributions to a Roth 401(k). Upon conversion, any earnings

on the after-tax contributions are taxed; once in the Roth, all future earnings are tax-free-assuming the participant meets the Roth qualified distribution rules. And these contributions are not included in the 402(g) calculation, they can help fill in the gap.

RULES

- The plan sponsor determines the number of conversions allowed per year.

- At the time of distribution, the Roth funds must satisfy the five-year clock requirements.

- The distribution must be taken after age 59 1/2 or upon death or disability.

MEGA BACKDOOR ROTH 401(k)

Heritage Wealth Architects can help make it easier for people to save up to the defined contribution limits while optimizing taxes by using the mega

backdoor Roth 401(k) feature. In-plan Roth conversion provides an opportunity to fill the gap between the 402(g) limits and the defined contribution limits.

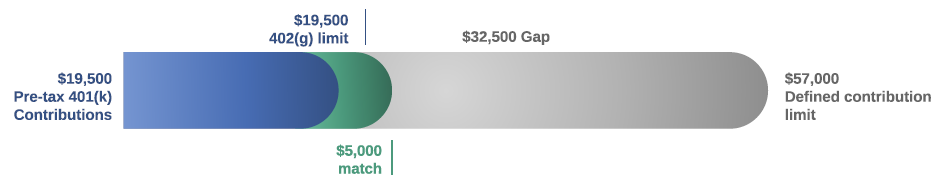

Let’s take the example of a participant in a plan with a 5% employer match; he earns $100,000 per year and maxes out his 402(g) contribution at

$19,500. With the employer match, his eligible DC contributions come to $24,500, falling $32,500 short of the $57,000 defined contribution limit.

This participant’s plan allows Roth conversions. Let’s say he wants to contribute another $10,000. He could make after-tax contributions to his 401(k) plan, and then convert it to Roth 401(k). If invests $10,000 and earns 2% prior to converting, for example, he would pay approximately $30 in taxes, and then all future earns would be tax-free.

This option provides tax diversity while allowing participants to contribute more than the 402(g) limit.

One challenge with the mega backdoor Roth 401(k) is that after-tax contributions must be included in the average contribution percentage (ACP) test along with matching contributions. It could be difficult to meet this requirement if only highly compensated employees (HCEs), or a large percentage of the HCEs,

To find out how Heritage Wealth Architects can help your participants with proactive plan design, contact Kurt S. Altrichter, CRPS®.